Special feature: Analysis of Brazil’s increased agribusiness exports, and its impact on container shipping & freight rates

Jun, 25, 2020 Posted by Sylvia SchandertWeek 202026

Despite the coronavirus, Brazilian agribusiness exports have been growing apace this year with pork exports showing the biggest percentage increase and soya exports to China heading up the volume statistics.

The rise in Brazil’s exports of agribusiness

On the export side, Brazil has bucked the trend of international trade despite deteriorating economic, political, and Coronavirus health crises and, according to several carriers and government sources, the agribusiness success story looks set to continue for the rest of 2020.

According to the Ministry of Agriculture, Brazil had its best April for agribusiness exports since 2013 and the Association of Private Port Terminals (ATP) noted that the overall trade surplus for the first four months of this year was US$19.7 billion, some 14.56% higher than the same period of 2019, although this is also due to falling imports.

Heated demand, especially from China, saw Brazil export 36 million tons of soya during the first three months of this year, according to Cargonave, the maritime agency, up 100% on the same period of last year.

And leading the way outside of the soya arena are pork exports. In fact, Brazilian pork exports smashed through two barriers during May of this year: they registered more than 100,000 metric tons and totaled more than US$200 million in revenue for the first time in a calendar month, according to the Association of Brazilian Animal Protein (ABPA).

Bolstered by African Swine Flu devastating domestic reared pigs in China, and the ongoing trade war between Donald Trump’s USA ( the world’s second-largest pork exporter with US$5.22 billion in sales and a 15.8% share of the overall market) and China, Brazilian exporters have made the most of favorable circumstances and during the first four months of this year, 10,002 TEU of pork was shipped to China and another 2,385 TEU to Hong Kong, according to Datamar’s statistics.

With total worldwide exports from Brazil for the period totaling 16,257 TEU that gives the two Chinese destinations a massive 76.19% market share. The next best is Singapore with a paltry 6%. With Russia slashing its share of the market over the past three years, from 43% in 2017 down to just 0.13%, Brazilian pork shippers have become very dependent on the Chinese market.

Francisco Turra, the president of ABPA and a former Agriculture Minister (for 18 months between 1998 and 1998, under President Fernando Henrique Cardoso), said that May’s pork exports were 52.2% higher than last year, and revenue was up 58.4%, achieving US$ 227.9 million.

In the accumulated result for the year (January to end of May), pork exports reached 383,200 tons, 34% above that achieved in the first five months of 2019. In terms of revenue, the balance was 54.8% higher, with US$878.3 million in 2020, according to ABPA figures. At this rate, Brazil is very likely to surpass Belgium and become the world’s seventh-largest exporter of pork, according to CIA figures in the US.

“We surpassed for the first time the level of 100,000 tons and US$200 million in a single month. Although extremely positive, it was a behavior expected by the sector for this year (due to early orders from swine flu-stricken China), even with the confrontation of the pandemic. While the sector maintains domestic supply and brings foreign currency to the country in this moment of severe crisis, sales to the international market contribute to reduce the increase in production costs,” said Turra.

The effect of increased exports on container shipping…

Such has been the success of meat exports in general to China and the Far East (chicken and beef as well as pork) that reefer equipment shortages have led to a number of Extra Loaders being deployed to bolster the available stock of containers for stuffing in Brazil.

None more famous than the arrival of the APL Paris (operated by CMA CGM) at Navegantes, rather than Santos, owing to vessel length restrictions. Other carriers have also inserted Extra Loaders to keep up the supply of reefer boxes to their shipper clients in Brazil, especially in the southern states [Parana, Santa Catarina, and Rio Grande do Sul] which are the engine room for chicken and pork exporters. Beef exports predominate out of Santos, where shortages have not been so pronounced.

To funnel empty reefers back to Brazil some carriers (including Maersk Line and Hamburg Sud) have used spare capacity on their European services and then transhipped back to South America. Some carriers also utilize spare capacity to Europe northbound by transhipping full reefer boxes, adding 10 to 14 days to the usual transit time of 35 days from Brazil to China.

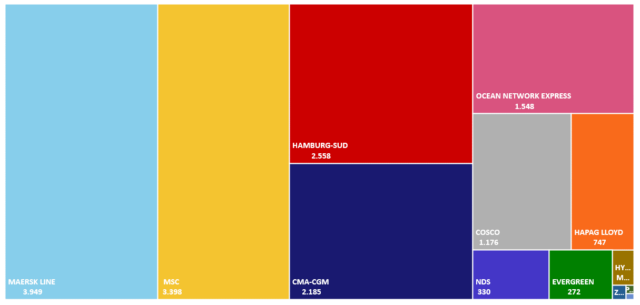

Maersk Line handled 3,949 TEU (24.3% market share) of port exports during the first four months of this year (Datamar data) while MSC handled 3,398 TEU (20.9%) and Hamburg Sud 2,558 TEU (15.74%). CMA CGM shipped 2,185 TEU (13.44% share) during the same period.

The following graph shows the amount of pork exported per carrier in TEU from Jan-Apr 2020:

Source: DataLiner (To request a DataLiner demo click here)

…and freight rates

Owing to stringent capacity control by the leading carriers on the trade lane – Maersk Line, CMA CGM, MSC, and Hamburg Sud – insertions of Blank Sailings have been made and freight rates for reefer export boxes have remained strong. A brief survey of eight freight forwarders and two carriers revealed a spot price range of between US$3,800 and US$4,200 per FEU, between June 19 and June 23, for one FEU of pork shipped from Santos to Shanghai.

One senior manager for one of the carriers involved in the ECSA-China trade lane told Datamar that this range was “about right for the spot market”, which has been fluctuating since the start of the year, but the long-term freight rate was much lower and long-term contracts, signed in April and for “significant and regular volumes” were more in the region of US$3000 per FEU.

These fluctuations, in terms of dry TEU, were backed up by Xeneta, the container ocean and air freight benchmarking and pricing platform, which indicated that a dry TEU from Shanghai back to Santos on the spot market had dropped from US$2500 plus at the start of 2020 down to just US$1000 in late April, early May before pushing back up to around US$1500 per TEU in early June. During this time the long-term (mostly contract) rates have held steady at US$1600 since the start of the year, after falling from US$2100 at the turn of the year. The early year highs were due to some Chinese ports being closed to deal with coronavirus outbreaks, causing a backlog.

Patrik Olstad Berglund, the CEO of Xeneta, told Datamar that China to Brazil had been “somewhat volatile as usual” since the start of this year.

“The carriers have done quite well during the Corona crisis balancing supply and demand so that long term rates are holding up quite well,” said Berglund. “The equipment shortage situation did allow them to jack up the rates for a while.”

Both Berglund and carrier executives added that the fall in demand for oil means bunker prices are coming down and this has also kept freight rates lower than they would otherwise be and the surplus of oil means prices may even come down in future months, even with tight capacity controls.

These rates from China are relevant to the pricing and availability of reefer boxes in Brazil as they affect the ability of carriers to return empties from their Chinese destinations.

Pork exports out of Brazil are heavily concentrated in the south of the country and Datamar data shows that the three southern states account for an incredible 98% of all shipments: Santa Catarina leads the way with 68% followed by Rio Grande, with 19.9%, and then Parana, with 10.8%.

The Itajai Port Complex (which includes Portonave in Navegantes, on the right bank, and AP Moller Itajai in Itajai itself, on the left bank) handled 10,280 TEU for the first four months (4,802 TEU for the former and 5,478 TEU for the latter) to give them a 63. 24% share of all Brazilian exports. The next best is Rio Grande with a nearly 20% share. Porto Itapoá has seen its share fall from 16% plus in 2017 to just under 5%, despite adding extra reefer capacity, as Hamburg Sud and Maersk Line have switched several services from Itapoá to the Itajai port complex.

Source: DataLiner (To request a DataLiner demo click here)

Article source: Rob Ward (Freelance journalist, DatamarNews)

-

Shipping

May, 21, 2021

0

Impacts of the end of Brazil’s maritime agreements with Argentina and Uruguay

-

Ports and Terminals

Apr, 01, 2019

0

Brazilian court decides Libra Terminals must continue operations at Santos

-

Shipping

Sep, 19, 2023

0

Maersk replaces paper Bill of Lading for digital blockchain records

-

Ports and Terminals

Jun, 28, 2022

0

Port of Santos workers accept deal to end strike

2 opinions about “Special feature: Analysis of Brazil’s increased agribusiness exports, and its impact on container shipping & freight rates”

Excelente informações e confiáveis.

Meu comentário é de que as informações são muito preciosas para o entendimento do comercio marítimo do Brasil dentro do contexto da globalização.