Brazil container throughput is expected to grow at an average annual rate of 6.5% until 2023, driving ECSA growth

Mar, 18, 2019 Posted by datamarnewsWeek 201912

Growth prospects for container handling on the East Coast of South America are positive for the next five years and should be approximately three times greater than GDP growth, according to the ECSA Container Terminals Report 2019, produced by Datamar in collaboration with Dr. Andreas Nohn, independent maritime consultant, who served from 2013 to 2017 as transportation economist at HPC Hamburg Port Consulting GmbH.

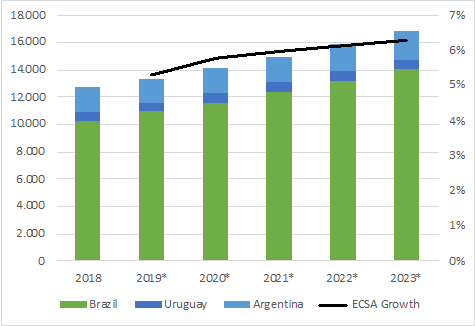

According to the research conducted with the directors and main authorities of 22 container terminals in Brazil, six in Argentina and two in Uruguay, the expectation is that the sector will grow 5.9% in the East Coast of South America, driven mainly by Brazil, which should increase container handling by 6.5% per year. In 2018, ports in all three countries handled 12.7m TEUs in all, representing an increase of 4.9% over 2017, when 12.1m TEUs were registered. According to the study conducted by Datamar, the volume of containers handled in Brazil should jump from 10.3m TEUs to 14.1 million TEUs by 2023.

ECSA Container Forecast 2019-2023 [‘000 TEU]

Of all the regions of Brazil, the one that presented the highest growth rate in economic modeling was the North region, where cabotage is widely present for the transportation of electronics and auto parts. The Port of Santos is likely to grow by more than one million TEUs, causing the greatest impact in absolute numbers. The report brings all the expected numbers and growth rates for each Brazilian region.

Another highlight is the forecast of the use of terminals in Brazil, that is, how much will be moved in relation to capacity, which should increase from 56.6% to 64.7% in 2023, considering the expansions currently planned by the terminals . The incorporation of larger vessels into fleets – 14,000 TEUs – will bring about regional navigation changes, since not all ports will have the capacity to receive larger vessels.

With the continued consolidation of the sector, the container transportation market in the ECSA region is increasingly concentrated. According to the report, the four largest shipowners – Maersk, MSC, CMA CGM and Hapag-Lloyd – account for 79.2% of all capacity planned in February 2019. In terms of maritime traffic, the four companies represent 82.3% of the total number of containers shipped in 2018. Of these four shipowners, two are partners in container terminals of significant relevance in Brazil. “The trend is for independent terminals to try to find their niche. If the optimism pointed out by the report comes to fruition, there will be room for everyone” says Datamar’s director.

For more information about the report or how to access it, go to:

https://ecsareport2019.datamar.com.br/

-

Meat

Apr, 10, 2024

0

Brazil chicken exports reach record volume in March

-

Other Cargo

Feb, 02, 2022

0

Russia has halted the export of ammonium nitrate

-

OTI Rankings

Oct, 11, 2021

0

OTI Rankings | DataLiner | Jan/Aug 2021 Brazil and Plate

-

Other Logistics

Oct, 23, 2023

0

Brazil reduced time bottlenecks in logistics, says study