Tobacco shipments expected to exceed US$2bn by 2019

Sep, 11, 2019 Posted by Sylvia SchandertWeek 201938

From January to August this year, Brazil shipped 345,000 tons of tobacco, which represented US$1.35bn in revenue for the country according to data from the Ministry of Economy. The numbers represent an increase of 30.4% in volume and 16.5% in dollars compared to the same period in 2018.

Until December, the expectation is to maintain the increase in shipments. According to a survey commissioned by the Interstate Tobacco Industry Union (SindiTabaco) alongside PriceWaterhouseCoopers (PWC), the trend shows an increase of 6% to 10% in dollars and 10% to 15% in the volume of tobacco shipped in 2019.

According to Iro Schünke, president of SindiTabaco, the Brazilian tobacco market has been stable in recent years and the increase is due to the postponement of shipments to China from late 2018 to early 2019. “Last year we had a drop in exports due to logistical issues and the customer’s decision to postpone shipments for the first half of 2019. As a result, this year’s shipments are expected to increase. Currently, Brazil has 25% to 30% of the world’s tobacco business and the survey indicates that we should maintain the leadership of world tobacco exports,” says Iro Schünke, president of SindiTabaco.

From January to August, tobacco accounted for 0.91% of total Brazilian exports and 4.73% of shipments from the Southern Region. Rio Grande do Sul, the largest tobacco producer in Brazil, accounted for 9.02% of total exports so far, shipping almost 285,000 tons and R$1.1bn.

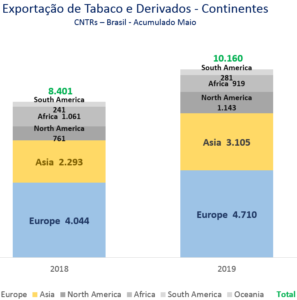

Around 85% of Brazil’s tobacco production is destined for export, which goes to 100 countries on all continents. The main market is the European Union, which in 2018 received 41% of exported tobacco. The second is the Far East, with 24%. Then comes Africa/Middle East, with 11%; North America with 10%; Latin America with 8%; and Eastern Europe with 6%. The main importing nation of Brazilian tobacco is Belgium, followed by the United States, China, and Indonesia.

The chart below, based on DataLiner data, shows the main destinations of Brazilian tobacco in 2018 and 2019:

Fonte: DataLiner/Datamar

-

Ports and Terminals

Oct, 20, 2020

0

DP World Santos starts operating two more regular services this month

-

Trade Regulations

Jul, 05, 2021

0

FAO and OECD project that Brazil will increase its weight as a food producer

-

Ports and Terminals

Feb, 23, 2022

0

APM Terminals Pecém achieves 10% container volume growth

-

Economy

May, 02, 2024

0

OECD Forecasts Upturn for Argentine Economy by 2025, Brazil’s Outlook Remains Stable