Brazil’s GDP is expected to grow 1.2% in 2022 according to National Industry Confederation

Dec, 20, 2021 Posted by Gabriel MalheirosWeek 202149

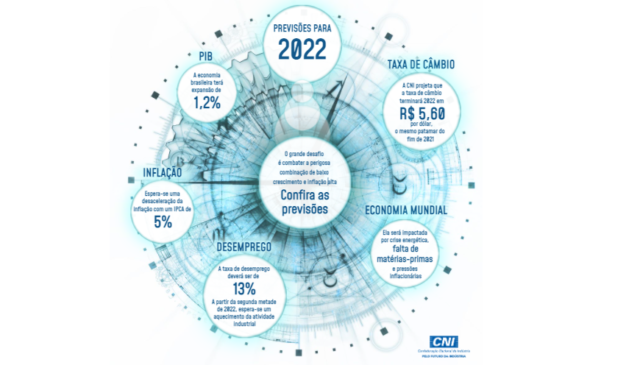

The Brazilian National Industry Confederation (CNI) expects Brazil’s GDP to grow 1.2% in 2022. Whereas this is the baseline scenario, one might still expect either more optimistic or pessimistic outcomes. According to Robson Braga de Andrade, CNI’s president, in order to bring the 1.2% estimative to fruition, it would be necessary to overcome, by the second half of the year, current problems like inflation, high unemployment rates, and the normalization of global value chains. The projection was included as part of the document “Brazilian economy: 2021-2022”, released on December 15th.

“The economy shall benefit from the normalization of family services – still running below pre-pandemic levels – and a few industrial sectors, mostly those connected to investments, like the construction market chain and capital goods, which might have their production levels incremented by the remaining of 2021’s orders and projects”, explains Robson de Andrade.

In the most pessimistic scenario, Brazil’s GDP growth in 2022 is expected to only reach 0.3% and, in the most optimistic one, Brazil could see a growth of 1.8%.

CNI predicts a growth of 4.7% in 2021

CNI expects to see a growth of 4.7% in 2021. The estimate is lower than what had been previously stipulated at the beginning of the year, due to the constant industry drops perceived in the second half of the year. Robson Andrade argues that while Brazil’s current GDP growth might revert the negative effects of 2020’s sub-optimal results, it does not mean that the structural problems and challenges aggravated by the crisis were overcome. There is still a noticeable drop in economic activity and next year’s prospects are not so thrilling.

“High inflation rates that lead to elevated interest rates, high household debt, high unemployment rates, inputs and raw material shortages, and rising energy costs are unfavorable factors undermining the country’s economic situation. Additionally, there are still many uncertainties regarding the pandemic, as well as fear of relapse as the one seen in Europe”, assesses Robson Braga de Andrade.

Brazil will have a positive trade balance in 2021

High exportation and importation rates are of great significance in 2021. While exports are mainly driven by prices, above all, commodity prices, imports have shown a total increase in terms of volume.

CNI’s assessment for exports, imports, and the 2021 trade balance are, respectively, US$ 278.4 billion (a 33.1% increase compared to 2021), US$ 219.5 billion (+38.2%), and US$ 58.9 billion (+16.9%).

As of 2022, the normalization of supplying inputs and raw materials and the real effective exchange rate – still quite undervalued – will give impetus to Brazilian exports and encourage import substitution. The CNI projects that exports might reach a total value of US$ 280 billion next year, a level slightly higher than in 2021.

Other highlights present in the document

Commerce, services and agriculture

– Commerce’s GDP shall increase by 6.5% in 2021. On the other hand, the GDP of the services sector, not taking commerce into consideration, shall grow by 4.2% this year. Lastly, agriculture shall operate at an expansion rate of 2%.

Construction industry

– The sector’s positive performance, above the expected, results in an accentuated revision of CNI’s projection, which was initially 5% but now reaches 8.2% in 2021. In 2022, the forecast is of an increase of 0.6%.

Raw materials

– The current shortage of semiconductors and chips will no longer cause production stoppages in large companies as of the second half of 2022.

– The risk of reduced magnesium production in China has the potential to cause an aluminum shortage, which would affect several industrial sectors. About 80% of the world’s magnesium production is Chinese.

Iron ore

– Exports to China represent almost 50% of the Brazilian iron ore economy. For 2022, the expectation is for a slowdown in the Chinese real estate sector and, consequently, a reduction in Chinese imports of iron ore.

Containers

– The expectation is that the transport of containerized cargo will only return to regular levels as of the second half of 2022.

Oil

– The price of oil and its derivates, including fuels, will remain high.

Energy

– Energy consumption is not expected to grow significantly. This expectation is based on the still retracted participation of “captive” consumers and the deficient growth that is expected in terms of the participation of free costumers, who are among the most electro-intensive.

Household income

– The average real income of employed persons dropped 11.1% between the 3rd quarter of 2020 and the 3rd quarter of 2021. For 2022, weak growth in consumption, constrained by low incomes, high inflation, and increased household debt.

Global economy

– In 2022 the global economy will be impacted by attempts to control persistent inflationary pressures, energy crisis and the lack of raw materials, given the imbalances in global input chains.

Commodities

– The lower growth rate affecting the global economy shall lead to a moderate drop in the prices of commodities that play an important role in the calculation of Brazil’s GDP.

Source: Agência de Notícias da Indústria

To read the full original article, visit the link: https://noticias.portaldaindustria.com.br/noticias/economia/cni-projeta-crescimento-do-pib-do-brasil-em-12-para-2022/

-

Shipping

Nov, 09, 2023

0

Maersk expands operations in Brazil with new call in Rio de Janeiro

-

DW 2019 EN

Jan, 13, 2020

0

DATAMARWEEK 14 JANUARY 2020

-

Ports and Terminals

Dec, 19, 2019

0

TCP gains AEO certification from the Department of Federal Revenue

-

Grains

Mar, 15, 2024

0

Agribusiness exports break record, reaching US$ 11.63 billion