Container handling in Brazil grows 3% from January to October 2019

Dec, 06, 2019 Posted by Sylvia SchandertWeek 201950

In the midst of national and international headlines about the reliability of Brazil’s economic statistics, Datamar released, three days ago, the data on the movement of containers exported and imported by Brazil relative to the charter of ships in October this year. Container movement is notoriously recognized by experienced consultants as a measure that well reflects the progress of a country’s economic activity. It is common among consultants in the maritime sector to use economic models that estimate container movement based on the predicted growth of Gross Domestic Product because of the reasonable correlation between the two variables.

The data from Datamar show that the movement from January to October 2019 grew 3% compared to the same period of 2018, jumping from 4.12m TEUs to 4.23m TEUs this year. The growth increase in the previous year was of 5% compared to 2017, so there was a slowdown from 5% to 3% in growth. According to global maritime consultants, the GDP growth multiplier for TEU growth has ranged from 1% to 4.2% over the last twenty years, pushed up or down by factors such as the pace of containerization of goods or by the increase of manufacturing outsourcing. Considering that Brazilian GDP grew by approximately 1.1% in the first three quarters of 2019, a 3% increase in movement results in a nearly 2.7 multiplier, quite reasonable for the east coast of South America.

If this relationship between GDP growth and container movement growth remains stable at around three to one, what can we expect from container volumes to be moved in Brazil in 2020? If the economy continues to grow at a pace of about 1%, the increase will be about 110,000 TEUs. If it grows close to the banks’ projected 2%, we could see an additional 220,000 TEUs.

In conclusion, we will depend on reality rather than the projections. The expectation for 2019 was for stronger growth, which did not materialize. And if we are having trouble getting the historical numbers right, imagine the difficulty of getting the future numbers right. The solution is to roll up our sleeves and work.

________________________________________________________________________________________________________________________

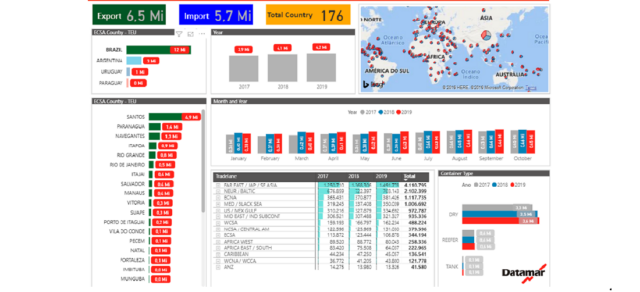

Datamar’s new dashboard easily and intuitively shows the current situation compared to previous periods. It can be noted that the Far East remains by far the most important region for Brazilian foreign trade, followed by Northern Europe and the Americas. It is also possible to see that the Port of Santos continues to dominate the movement of containers in the country, with twice the volume of the next Brazilian ports, Paranaguá and the Itajaí and Navegantes complex.

Datamar provides analyses such as this and others of Brazilian foreign trade and the entire east coast of South America, as well as Chile, through DataLiner, the company’s flagship. DataLiner is a database that provides a complete view of South America’s foreign trade maritime flow. It includes information about shipowners, ships, ports and terminals, exporters and importers, as well as shipped goods and their origins and destinations.

Datamar recently launched intuitive dashboards to merge DataLiner information with a variety of other sources of information, resulting in an analytical tool that is easier to understand and use.

-

Ports and Terminals

Aug, 08, 2024

0

Record-Breaking Surge: Containerized Cargo Throughput Hits All-Time High in First Half of the Year

-

Ports and Terminals

Aug, 05, 2019

0

La Plata Port reduces import tariffs in Argentina

-

Grains

Apr, 17, 2023

0

Brazilian agro exports soar to record high USD 16 bn; sector accounts for 47.2% of shipments

-

Ports and Terminals

Nov, 29, 2023

0

Corn dominates October shipments through Port of Santos