DataLiner details the main cuts of meat exported by Brazil

Mar, 28, 2021 Posted by Ruth HollardWeek 202113

In 2020, Brazilian meat exports continued throughout the year, and exports grew because of both the devaluation of the real, which made Brazil’s prices more competitive abroad, and by the African swine flu that hit China and devastated much of its herds, leading the country to considerably decrease its reserves and increase its exports, benefiting Brazil.

Brazilian Meat Exports (HS 0202, 0203, and 0207) | Jan 2017 to Jan 2021 | TEU

Source: DataLiner

Despite the growth, the year 2020 was also marked by suspension and subsequent recovery of the right to export by some refrigeration plants due to cases of Covid-19 among workers. Also, China pressured Brazil and other exporting countries to disinfect the outer packaging of products and the inside of containers before sealing export products to ensure the safety of food imported from the cold chain and to increase consumer confidence in imported products.

Beef

DataLiner data show that beef exports in 2020 grew 12.60% compared to 2019, maintaining the same growth pattern observed previously. In 2019, beef exports were 12.52% higher than in 2018. During June, July, August, October, and November, new export records were set, comparing with data since 2017.

In January 2021, there was a slight drop of 0.17% in exports compared to the same period of the previous year.

The Port of Santos was the main outlet for Brazilian beef in 2020, exporting 66.39% of all beef exports, followed by Paranaguá, exporting 18.90%, Vila do Conde with 5.35%, and Rio Grande with 3.87%.

The main destinations for beef in 2020 were: China (56.60%), Hong Kong (13.39%), Egypt (7.53%), and Russia (3, 43%).

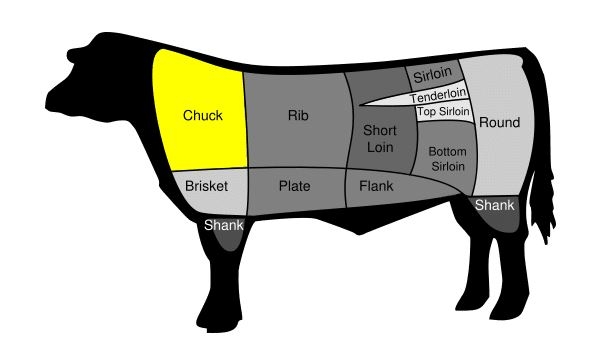

The following chart shows the main cuts of meat exported by Brazil in 2020:

Brazilian Beef Exports (HS0202) by Cut | Jan to Dec 2020 | TEU

Source: DataLiner

Analyzing only the Chuck roast cut, the main destinations were: China (81.12%), Russia (7.41%), and Taiwan (5.07%).

The main destinations for the Brisket cut in 2020 were: China (89.78%), Libya (2.92%), and Russia (2.52%).

Pork

2020 pork exports grew 45.58% compared to 2019, more than double the growth from 2018 to 2019, which was 20.40%. It is worth mentioning that between April and November, records were set monthly comparing data since 2017.

When comparing the months of January of the last three years, it is possible to see that in January 2020 there was a significant increase of 65.01% in pork exports compared to January 2019. In January 2021, there was a 4.34% drop in volume exported compared to January 2020.

The largest volume of Brazilian pork exported in 2020 was through the Port of Navegantes, with 32.42% of the total, followed by Itajaí, with 30.76%, Rio Grande, with 19, 68% and Paranaguá with 11.22%.

The main destinations for Brazilian pork were: China (62.01%), Hong Kong (12.79%), Singapore (6.67%), and Vietnam (4.85%). Check the chart below:

Main Destinations for Brazilian Pork Exports (HS 0203) | Jan to Dec 2020 | TEU

Source: DataLiner

Chicken

Chicken meat remained the most stable in 2020, as well as in the previous three years.

In 2019, exports grew 2.55% in the volume exported over 2018 and, in 2020, a small decrease of 1.38% was seen in comparison with 2019.

Comparing only the months of January, we can see a greater variation: the volumes exported in January 2021 were 7.35% lower than in the same period of 2020, which, in turn, were 15.37% higher than those of January 2019.

Port of Paranaguá maintained the leadership position as the exit door for Brazilian poultry meat, handling 42.86%, Navegantes was in second place, with 19.18%, Itajaí ranked third, with 16.70%, and Santos ranked fourth, with 8.28%.

The main destinations for Brazilian chicken meat were China (16.07%), Saudi Arabia (12.12%), Japan (10.97%), and the United Arab Emirates (7.76%).

See the main cuts of poultry exported by Brazil in 2020 below:

Brazilian Chicken Exports (HS0207) by Cut | Jan to Dec 2020 | TEU

Graph source: DataLiner (To request a DataLiner demo click here)

-

Shipping

May, 13, 2021

0

Containership Time-Charters Break New Records

-

Ports and Terminals

Jun, 27, 2024

0

CODEBA joins the ICLEI global sustainability network

-

Ports and Terminals

May, 13, 2019

0

Codesp considers seven emergency dredging offers

-

Ports and Terminals

Oct, 17, 2021

0

Santos: a port without crisis