Economic defense body identifies problems with Port of Santos terminal auction

Jun, 30, 2022 Posted by Gabriel MalheirosWeek 202226

The General Superintendence of Brazil’s Administrative Council for Economic Defense (CADE) issued, on Wednesday, June 29, a technical note identifying possible market concentration problems arising from the auction of a container terminal in the Port o Santos, which would reinforce the verticalization of Maersk and MSC in the country.

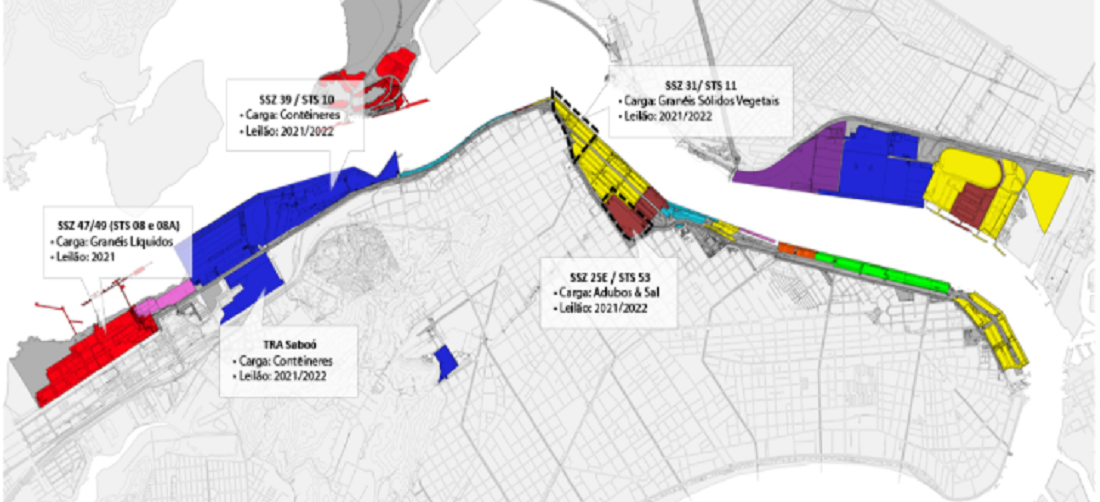

The STS-10 zone, known as Cais do Saboó (“Saboó’s Wharf”), has a 600 thousand square meters area adjacent to another site currently occupied by BTP Santos, a joint venture for container handling by Maersk and MSC.

According to the technical note emitted by CADE, if BTP Santos is awarded the contract for STS10, its handling capacity would increase from 2 million to 4.32 million TEUs per year, “allowing its shareholders Maersk and MSC to boost cargo throughput in their own terminal indiscriminately, which is currently not possible due to the lack of idle capacity of the BTP terminal in Santos.”

See below the top 10 origins of the container imports that arrive at the Port of Santos by country in 2022. The data below is from DataLiner.

Top 10 container import origins | Port of Santos | Jan 2022 – April 2022

Source: DataLiner (click here to request a demo)

Maersk and MSC are the only two vertically integrated carriers with port terminal services in Brazil, according to CADE’s technical note prepared to help Antaq (National Waterway Transportation Agency) to formulate how the auction of the Port of Santos-located terminal will develop. MSC own shares in the container terminals Multi-Rio (RJ), Portonave (SC), Vila Velha Terminal (ES); Maersk, on the other hand, holds shares in the container terminals APMT Pecém (CE), APMT Itajaí (SC) and Itapoá (SC).

According to ABTP (Brazilian Association of Port Terminals), the presence of shipowners and companies that operate in the transport of containers in auctions such as the STS-10 can affect freight.

“The indiscriminate and unregulated participation of companies that are prominent in the maritime transport of containers in the bidding processes can generate increases in freight prices in the long term and reduce available routes for the flow of Brazilian cargo,” said ABTP president Jesualdo Silva.

Source: Folha de S. Paulo

To read the full original article, please go to: https://www1.folha.uol.com.br/mercado/2022/06/superintendencia-do-cade-ve-eventuais-problemas-em-leilao-de-terminal-no-porto-de-santos.shtml

-

Ports and Terminals

Sep, 03, 2024

0

Itapoá Port Sees 15% Productivity Increase with New Portainer, Expanded Operations

-

Grains

May, 30, 2023

0

Brazil loses USD 750m worth of grains due to logistical bottlenecks

-

Meat

May, 22, 2023

0

Colombia approved to export beef, pork by products to Brazil

-

Ports and Terminals

Oct, 06, 2023

0

CODERN port authority strives to establish new shipping line at Natal Port