Iron ore futures plummet in China following Vale disaster

Aug, 02, 2019 Posted by datamarnewsWeek 201932

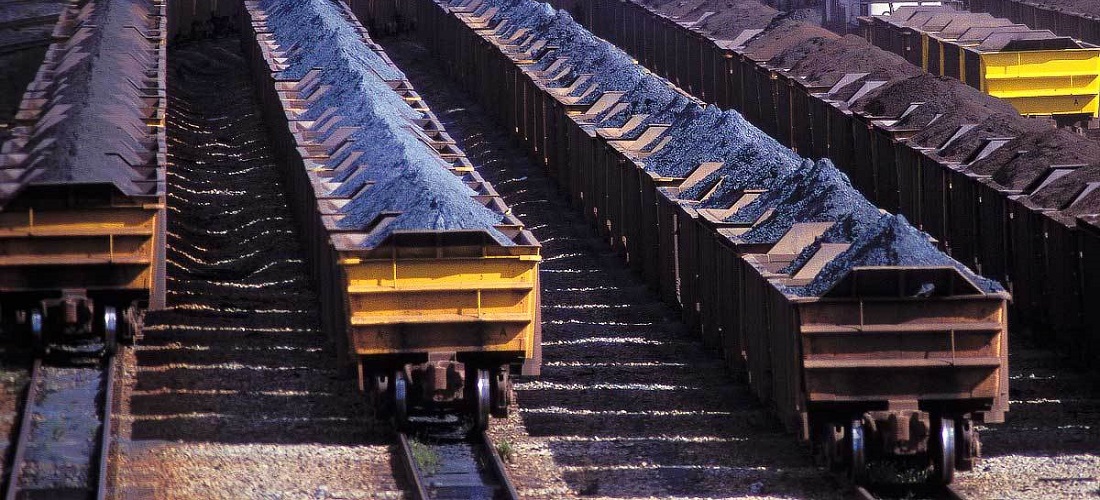

China’s iron ore futures contracts fell nearly 5% on Friday (08/02) and are preparing for their second weekly loss after Brazil announced a recovery in steel exports in July when Vale resumed the operation of its largest mine, the Brucutu mine.

The most-traded iron ore on the Dalian Commodity Exchange, due January 2020, fell 4.8% to 720.50 yuan (US$103.85) a ton. It fell 2.5% at 0242 GMT.

Brazilian iron ore exports rose 16.6% in July from the previous month to 34.3m tons, the highest level in nine months, according to official data.

Concerns about the global iron ore shortage as a result of bans at Vale’s Brucutu mine for safety checks following the Brumadinho disaster in January have led Dalian iron ore to hit records this year, thus affecting global iron ore futures.

Spot prices have reached their highest level in more than five years, with recent supply cuts in Australia raising concerns.

Vale SA, the world’s largest iron ore exporter, has been trying to boost production and company executives said this week it now has an annual iron ore capacity of 340m to 345m tons.

Source: Reuters

-

May, 31, 2019

0

GDP falls 0.2% in the first quarter of 2019

-

Shipping

Jul, 12, 2019

0

Freight rate rises 6% from Brazil to China

-

Grains

Aug, 13, 2019

0

US corn crop might be greater than expected

-

Ores

Jul, 03, 2019

0

Brazil’s exports of iron ore down 16.7% in June