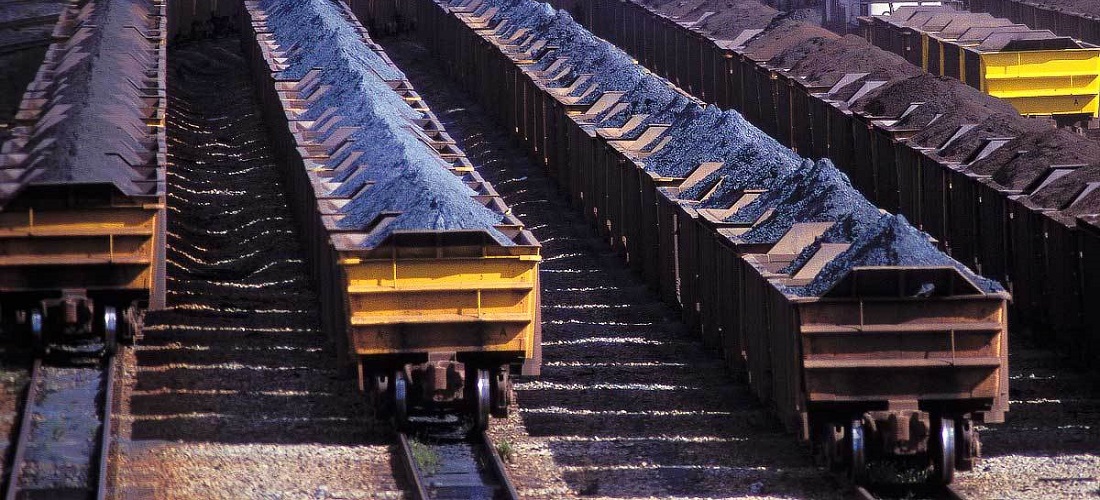

Iron ore prices plunge in China, registering lowest level in four months

Aug, 05, 2021 Posted by Ruth HollardWeek 202131

The perception that China will continue to impose restrictions on steel production in the country – in theory, to meet China’s environmental goals – led to a new round of devaluation of iron ore in the spot and futures markets this Thursday.

According to the specialist publication Fastmarkets MB, one ton of ore with 62% iron content was reduced by 6.6% at the port of Qingdao, to US$ 171.55.

As a result, in August, the commodity began to show an accumulated decline of 5.5%, and earnings in 2021 were reduced to 6.9%. With today’s low, the price of the main steel raw material fell to the lowest level in four months on the spot market.

On the Dalian Commodity Exchange, the most traded contracts for September fell below the 1,000 yuan per ton mark, with a devaluation of 5.6%, and ended the day session at 999 yuan (about US$ 154) per ton.

-

Grains

Feb, 05, 2020

0

China to use corn reserves to alleviate shortages amid virus epidemic

-

Apr, 26, 2024

0

Blueberries – Global Demand on the Rise

-

Trade Regulations

May, 21, 2021

0

Potential barriers may have an impact of US$ 46.2 billion on Brazilian exports, shows study by CNI

-

Grains

Jul, 25, 2024

0

Rice exports in Brazil benefit from heated international demand