Lack of Clarity in European Anti-Deforestation Law Worries Brazilian Exporters

Jun, 06, 2024 Posted by Gabriel MalheirosWeek 202423

Representatives from Brazil’s meat, leather, and soy export industries have voiced concerns over the lack of clarity from European Union authorities regarding the implementation of the bloc’s anti-deforestation law (EUDR). Set to take effect in early 2025, the law will require proof of origin and compliance with socio-environmental criteria for these and other products.

During the 3rd Future of Agro Forum, organized by Globo Rural in São Paulo in partnership with the Institute of Forestry and Agricultural Management and Certification (Imaflora), participants highlighted the “total uncertainty” surrounding the procedures Europeans will use to verify information provided by Brazilian companies.

There is also ambiguity about whether private initiatives already adopted in Brazil will be accepted in Europe.

André Nassar, executive president of the Brazilian Association of Vegetable Oil Industries (Abiove), stated that exporting companies already have mechanisms in place to monitor the legality of production. However, there are no definitive answers from the European side about whether these measures will be recognized for compliance with the anti-deforestation law.

“The competent authorities don’t know what to do. The European Commission is stuck, completely at a standstill,” Nassar said at the event. He noted that European countries have scattered initiatives for pilot projects to commercialize soybeans in line with EUDR rules, but it remains unclear whether these models will be approved by the bloc’s authorities.

“The level of uncertainty is enormous. We believe we are prepared to comply with the legislation, but no one says whether what we do here is enough. We will know as the cargoes arrive,” he added.

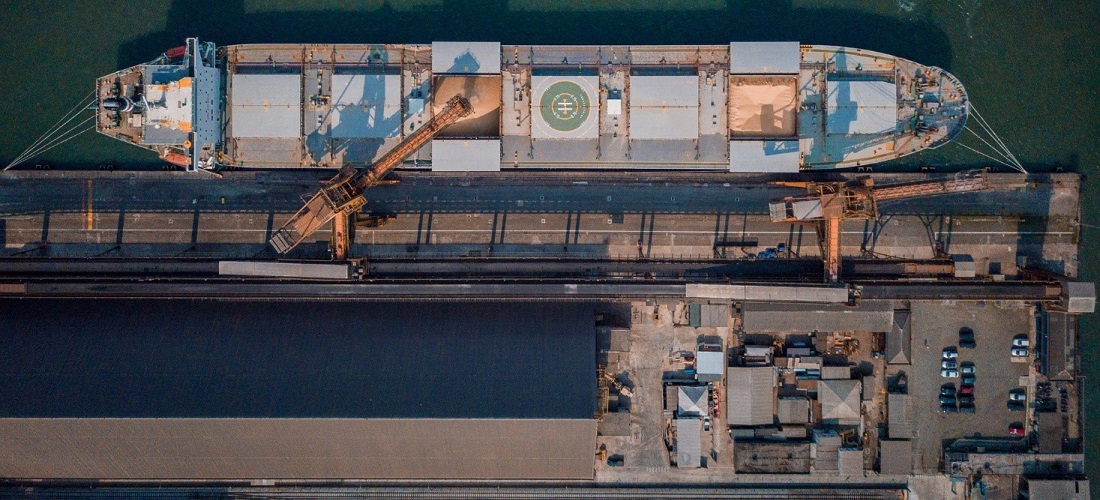

In fact, ships docking in European ports from January 1, 2025, must already comply with the new rules. However, clarifications need to be provided beforehand, prior to when containers are stuffed in Brazil, to ensure the entire process is implemented smoothly.

The following chart displays Brazilian container exports to the European Union from January 2021 to April 2024, according to data derived from DataLiner.

Container Exports to EU | Jan 2021 – Apr 2024 | TEUs

Source: DataLiner (click here to request a demo)

Nassar endorsed the creation of the AgroBrasil+Sustentável platform, being developed by the Ministry of Agriculture, to provide transparency to national data and facilitate acceptance by Europeans. “It has to be done by the government. It will represent a real shift in the way we generate information and allow it to move along the chain in a harmonized way,” he concluded.

Marcello Brito, executive secretary of the Consórcio Amazônia Legal, believes the implementation of the law may be delayed due to the complexity of operationalizing the rules. However, he emphasized that the European Union is committed to applying socio-environmental charges and that Brazil must prepare to leverage this new global dynamic.

“Despite the problems, this also represents an opportunity. The debate is about not missing the chance to showcase the up-to-date process we abide by in Brazil,” Brito said at the event. He stressed that global discussions are focused on mitigating carbon emissions and that Brazil can highlight its environmental assets in this context.

Opportunities

For Paulo Pianez, Director of Sustainability at Marfrig/BRF, the socio-environmental movement initiated in Europe is set to spread globally, impacting more commodities. He criticized Brazil for not leveraging the opportunities presented by these new requirements.

“I see this movement started by Europe as inexorable. In my view, Brazil and other countries have not seized the opportunity to provide the appropriate response. Our vision and narrative are currently very reactive, which is insufficient for these legislations,” he said. “[The term] avoided deforestation is a misnomer; it’s about preserved natural capital. Our positioning could be more appropriate and optimistic,” he added.

Pianez highlighted that the Brazilian meat sector could already be prepared to meet the European anti-deforestation law; however, this endeavor is contingent on internal advancements in creating a national bovine traceability system. Utilizing existing tools and data already in place, such as Animal Transit Guides (GTAs) and the Rural Environmental Registry (CAR), alongside technology and financial and technical support for producers, would enable compliance with the legislation.

“This approach would not only address legislative compliance but also demonstrate that Brazil can environment-aware export meat at a standard unparalleled by any other country,” he said. He emphasized the need for a public policy instructing individual traceability for effective monitoring.

The leather sector is also very likely to feel the effects of the legislation, with around 25% of Brazilian exports destined for Europe. Ricardo Andrade, Sustainability and Institutional Relations advisor at the Brazilian Tanning Industry Center (CICB), mentioned that the entity developed a guide to help companies comply with European monitoring requirements.

The primary challenge lies in deploying a traceability system throughout the entire chain, from the animal to the final product. While industrial traceability data is available, European law mandates tracing leather back to farms.

“If we had an individual identification system, it would simplify obtaining information from each farm, but this is not yet a reality in Brazil,” Andrade said.

“If I had to export today under EUDR regulations, there would be significant problems, as current practices rely on industrial traceability certification without a comprehensive view of the production process. In practice, this would likely result in substantial restrictions,” he added.

Cecília Korber Gonçalves, project manager at ProForest, announced that the group will launch a pilot project to implement the European Union’s anti-deforestation law within grain trading, slaughterhouses, and a leather company. The goal is to test the procedures needed to comply with the rules.

“Solutions do exist, but we face immense operational challenges. We will test these procedures individually and then present the results,” she said.

Source: Globo Rural

Click here to read the original piece: https://globorural.globo.com/especiais/futuro-do-agro/noticia/2024/06/falta-de-clareza-na-lei-antidesmatamento-europeia-preocupa-exportadores-brasileiros.ghtml

-

Grains

Oct, 06, 2021

0

Soybeans: Brazil to export 2.68 million tons in October

-

Ports and Terminals

Jun, 30, 2022

0

New private terminal contracts provide for BRL 10.5bn investments

-

Ports and Terminals

Aug, 10, 2023

0

Wilson Sons’ profit increases 23% in the first half. Revenues up 9% to R$1.2bn

-

Shipping

Jun, 18, 2021

0

Liner congestion spreads across the planet, 304 ships queuing for berth space