Maersk and MSC are caught up in the STS10 auction dispute in the Port of Santos

Mar, 10, 2022 Posted by Gabriel MalheirosWeek 292210

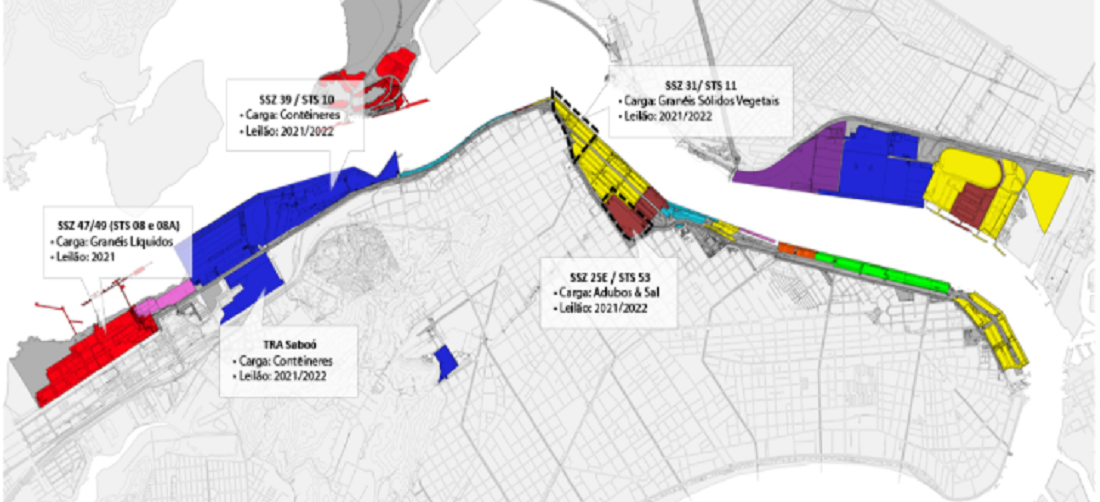

Maersk and MSC are caught up in the STS10 auction dispute. The auction of the mega container terminal, which was put up for public consultation this week, has sparked controversy regarding both companies’ participation in the tender. On the one hand, port operators see these groups as posing a risk of excessive market concentration. But, on the other hand, shipowners claim fear of fair competition on the part of other groups.

Maersk and MSC are the world’s two largest shipping companies. Through their subsidiaries, APM Terminals and TiL (Terminal Investment Limited), the companies also operate port terminals that receive cargo from vessels.

In Brazil, the groups jointly control a container terminal in Santos, the Brasil Terminal Portuário (BTP), and also have other terminals throughout the country, separately.

Companies that operate containers in the country are concerned that the shipowners will begin directing cargo to their own terminals, thereby emptying independent terminals and reducing competition, not just in Santos but throughout the Brazilian market.

“Shipping companies choose where to dock their vessels, and they pay terminals for it. So, obviously, if given the change, they will prefer using their own facilities. Today, BTP has limited capacity, so shipowners are forced to use independent terminals to complement their services,” says Angelino Caputo, executive director of the Brazilian Association of Bonded Terminals and Premises (Abtra).

For Patrício Júnior, director of terminal investments at MSC’s TiL, this fear has little to do with reality. In fact, he argues that these complaints are voiced by other companies interested in the STS10 who want to avoid competition.

“The history of TiL and MSC is not one of predatory nature. Instead, it tells a narrative of development, job creation, and good price policies that respect market values. Whoever is speaking [against the companies] wants to participate in the tender and doesn’t want us to enter the competition. We just want to fulfill our right to compete,” he says. “Ten years ago, when BTP entered Santos, those same ‘knights of the apocalypse’ said the prices would increase. Today we see that the opposite has happened; values have dropped,” he adds.

However, the government acknowledges that market concentration by shipowners is a genuine concern. Thus, Maersk and MSC were banned from participating in the STS1O tender together as they did with BTP. Both of these companies may compete separately or in consortium with other groups.

According to anonymous industry sources, restricting these two companies from participating is not enough to prevent market concentration. One source recalled that, globally, Maersk and MSC ally to share ships on long-haul voyages.

The Ministry of Infrastructure says that limited participation proved to be sufficient in the simulations carried out in preparation for the tender. “The study used as a basis for the public notice issued indicated that there is only the risk of economic power abuse when these two companies unite in a consortium. Individually, we see no problem at all,” says the Secretary of Ports and Waterway Transportation, Diogo Piloni. “It is best for the market is the private sector competing as freely as possible. However, we are now opening the public consultation, and we will evaluate all of the studies and concerns that have been presented,” he says.

The public consultation stage shall run until April. The government’s objective is to hold the auction later this year, in the fourth quarter.

Abtra went to the extent of filing an (unsuccessful) request with the National Waterway Transportation Agency (Antaq) to try to keep the public consultation phase from starting this week. At this point, it seems that critics will focus on voicing their grievances in the public consultation. However, it is unlikely that the dispute will end there.

Several other arguments, in addition to the risk of market concentration, have been weaponized against the auction. For example, some argue that having the STS10 operating would generate excess capacity and idleness in other container terminals because the currently available structures could easily meet the demand for the coming years, a hypothesis that the government refutes. Other critiques focus on the relocation of the fertilizer and passenger terminals that would be “displaced” by STS10, among other points.

Contentions over terminal leasing are not an isolated Brazilian feature. Shipping companies have been under pressure worldwide, fighting claims of market concentration and verticalization of operations. Moreover, these groups became increasingly targeted during the pandemic when sea freight soared due to many factors such as lockdowns in ports and global supply and demand imbalances.

In Brazil, the pressure felt has not been as strong in other countries. For example, in the United States, President Joe Biden directly criticized the alliances formed by shipping companies. Here, however, questions have been increasingly raised. In 2021, the Administrative Council for Economic Defense (Cade) opened an inquiry to investigate Maersk and MSC operations in Santos. The process is still open.

Patrício, from TiL, says that the company has gathered enough data to prove that the group does not have any discriminatory practices at the port. “They’re trying to postpone our participation,” he claims.

Maersk did not have any comments.

Source: Valor Econômico

To read the full original article, please go to:

https://valor.globo.com/empresas/noticia/2022/03/10/leilao-gera-disputa-contra-maersk-e-msc.ghtml

-

Shipping

Jan, 11, 2023

0

A.P. Moller – Maersk announces new executive leadership team

-

Grains

Dec, 20, 2019

0

Argentina: Grain export tax expected to generate additional revenues of US$750m

-

Ports and Terminals

Feb, 07, 2023

0

Almost 400 kilos of cocaine is seized at the Port of Itaguai, Rio de Janeiro.

-

Ports and Terminals

Nov, 23, 2023

0

Itajaí-Açu Port Complex: cargo throughput and operation highlights for October