Santos Port Authority reports 12% net revenue growth in second quarter

Aug, 26, 2020 Posted by datamarnewsWeek 202035

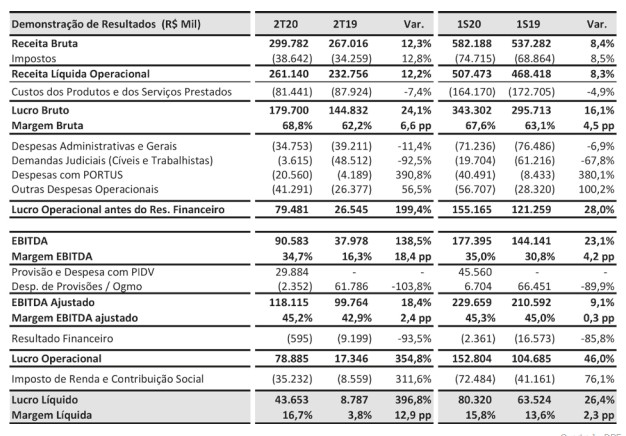

The Santos Port Authority (SPA) recorded net revenue of R$261.1 million in the second quarter, up 12.2% year-on-year, driven by the strong movement of cargo in the April-June period when Santos handled 38.8 million tonnes – a 17.2% rise on year-ago levels. This mainly reflects strong agribusiness exports and the exchange rate that is favorable for exports.

Moreover, actions focused on rationalizing costs and increasing revenue, in search of consistent gains to improve economic and financial sustainability, resulted in a gross profit of R$179.7 million, an increase of 24.1% over the same period last year, with a 6.6% increase in gross margins to 68.8%.

The cash generation capacity, measured by earnings before interest, taxes, depreciation, and amortization (Ebitda), also increased significantly. Adjusted for extraordinary effects, the Ebitda grew 18.4% and reached R$118.1 million, with a 45.2% margin – an increase of 2.4%.

The good performance in revenue combined with efficiency gains and cost reductions led SPA to record net income of R$43.7 million in the quarter, almost 5 times the R$8.8 million registered in the second quarter of 2019. In the semester, SPA also obtained a positive result in the last line of the balance sheet. Net income for the year to June reached R$80.3 million, an increase of 26.4% over January-June 2019.

Details on revenue and performance

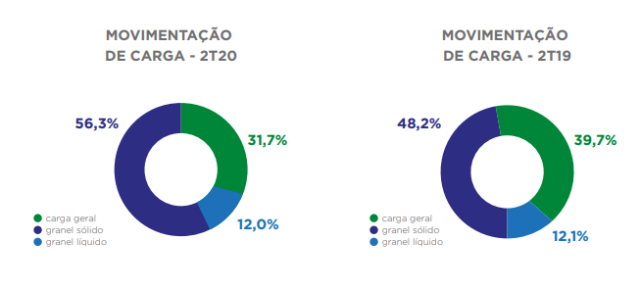

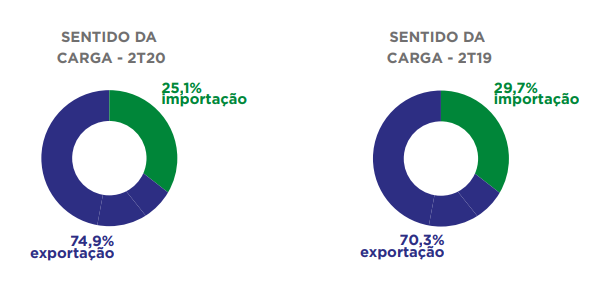

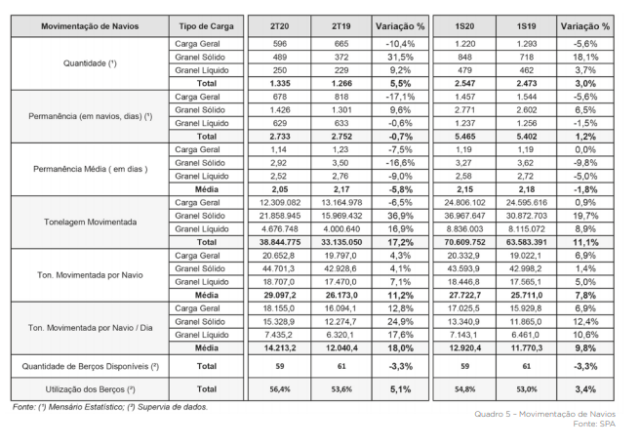

Cargo handling: In general terms, the good performance of the second quarter reflected the improvement in export volumes via Santos, compensating for the reduction in the surplus observed due to lower imports (mainly in containers). The highlight for the period was the growth of almost 37% in solid bulk, driven especially by greater volume shipments of soy and sugar. Meanwhile, general cargo/containers, more directly related to the

imports, showed a decrease of 6.5% in the period.

Number of vessels and use of berths: A total of 1,335 vessels operated during the second quarter – an increase of 5.5% over the volume of ships in the second quarter last year. The rate of use of berths increased from 53.6% in second-quarter 2019, to 56.4% this year.

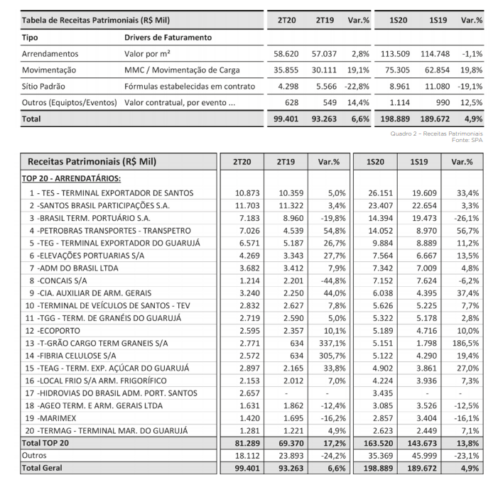

Equity income: Equity income grew by 6.6% in the 2nd quarter of 2020. The main highlight was the 19.1% increase in charges linked to cargo handling. The portion of equity income linked to rent, charged per square meter, increased by 2.8% in the period and was the result of the contractual adjustment based on the IGPM (7.31% in the last 12 months) and the signing of 3 new transitional contracts in the Saboó region, which offset the effect of some contracts terminated during 2019.

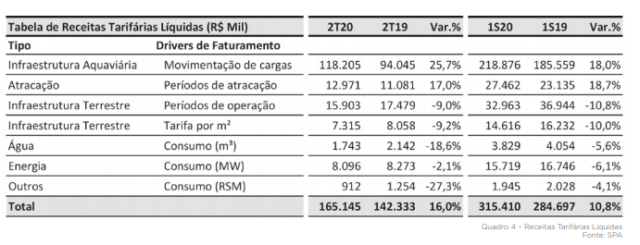

Tariff revenues: Tariff revenues grew by 16% in the 2nd quarter of 2020 compared to the same period in 2019. In the analysis by type of tariff revenue, the positive highlight was the increase in cargo handling (+25.7 %) and mooring periods (+ 17.0%). On the other hand, land infrastructure tariffs maintained the trend observed in the first quarter, decreasing by 9% as a result of the greater movement in the period and in the rental of berths at terminals,

which pay lower tariffs for not using terrestrial infrastructure resources. It is also worth mentioning that there was no tariff adjustment in the period under analysis.

-

Other Cargo

Oct, 17, 2024

0

Sindiadubos Paraná holds 18th edition of NPK Symposium in Curitiba

-

Other Logistics

Aug, 01, 2024

0

Tietê-Paraná waterway sees 5.8% surge in cargo transport amid infrastructure upgrades

-

Economy

Apr, 04, 2023

0

Decreased imports sustain Brazil’s surplus balance in 1Q23

-

Grains

Apr, 24, 2023

0

U.S. buys Brazilian soybeans after price drop