VLI prepares for Ferrogrão and commits to Northern Arc logistics

Apr, 19, 2021 Posted by Ruth HollardWeek 202117

The railway operator VLI Logística is preparing to participate in the auction of Ferrogrão, a project by the federal government valued at over a billion reais to build a railway connecting Brazil’s Midwest region to Pará. According to the company president, Ernesto Pousada, the company’s goal is to consolidate its presence in the agricultural flow corridor through the northern region of Brazil.

“Ferrogrão will be a very competitive project; we are studying it in depth. We are currently doing an internal evaluation while we survey possible partners to form a consortium, as needed. It is a large undertaking which will require different levels of expertise,” says Pousada. The group’s shareholders are Vale, Mitsui, FI-FGTS, BNDES Participações, and Brookfield.

There is no date set for the Ferrogrão auction; it will still have to overcome a series of hurdles to get off the ground. The project is currently temporarily halted due to an injunction from the Brazillian Supreme Court. There is also the risk of questioning by the Federal Audit Court (TCU), which will need to endorse the bid notice. Despite criticism, the federal government is prioritizing the project.

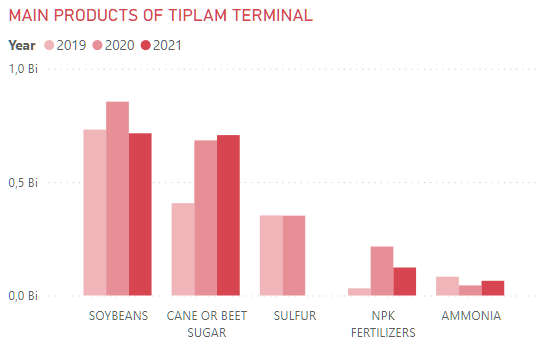

In the meantime, VLI’s Santos terminal, TIPLAM, continues to play an important role in the company. Datamar data show that the main products passing through the terminal are soy and sugar.

Handling at the terminal increased in 2020 compared to 2019, with a higher number of vessel calls. So far in 2021, the number of vessel calls is on the same level as in 2020.

With or without Ferrogrão, VLI defined Brazil’s Northern Arc as a priority in its strategic planning. It is even more of a priority with the expedited renewal of the Centro Atlântica Railway (FCA) contract, which is under discussion and expected to occur in 2022. “We are focusing on extending the FCA, but the main plan is growth in the northern region. It is our focus; it is where we want to go”, says Pousada.

Today, the company operates two concessions: the FCA and the northern section of the North-South Railway (between Tocantins and Maranhão), where the company already has agribusiness flow operations. On this route, the cargo goes up through the North-South, passes through the Carajás Railroad held by Vale (VLI’s largest shareholder), and arrives at the port of Itaqui (MA).

According to Pousada, in the last five years, VLI has invested R$ 997.6 million in the North-South. For the next three years, the plan is to invest R$ 700 million, mainly in rolling stock acquisitions and terminal expansions. The investments are in the contract, but some will be expedited to guarantee corridor capacity.

Other projects in the region to be studied are FICO (the midwest integration railway), between Mato Grosso and Goiás, and sections 2 and 3 of FIOL (the west-east integration railway), from the state of Bahia to the state of Tocantins. Both railways will interconnect to the North-South Railway. The federal government considers auctioning the sections in blocs to form another agricultural-flow corridor from the Midwest to the coast of Bahia. However, the modeling and deadline for the public notice have yet to be defined.

“We are in the first stages of analyzing this project. FICO is a railroad that interests us very much. If there is a FICO-FIOL corridor, we will explore the potential and, in time, make the decision. Primarily, we are interested because they are railroads that lead to the north. The north is the future; it is the north that will change Brazilian logistics. In addition to Mato Grosso, the Matopiba region [Maranhão, Tocantins, Piauí, and Bahia] will also benefit from the expansion”, stated Pousada.

He has also stated that the federal government is leading negotiations for the expedited renewal of the FCA contract. The company’s objective is to renew the contract for another 30 years in exchange for R$ 13.8 billion in investments and a grant of R$ 3.3 billion – the amounts are still under discussion.

The discussions, however, are expected to be tough. The difficulty is that it is an extensive 7,220-km network that crosses seven States: Bahia, Sergipe, Goiás, Minas Gerais, Espírito Santo, Rio de Janeiro and São Paulo. Earlier this year, public hearings were held where questions were asked and an apparent dispute arose between resource-generating states. The Ministry of Infrastructure plans to end the process next year.

-

Shipping

Feb, 06, 2020

0

Maersk appoints Brazilian for first time to lead East Coast South American operations

-

Economy

Feb, 16, 2024

0

Brazil has record food exports to Africa

-

Ports and Terminals

Jun, 22, 2023

0

TIL plans to invest BRL 7 billion in Santos and Navegantes

-

Economy

Apr, 28, 2023

0

Argentina ditches dollar to pay yuan for China imports