A Shell Argentina pretende produzir 70 mil barris de petróleo por dia até 2025

jan, 03, 2019 Postado pordatamarnewsSemana201901

A Shell Argentina planeja desenvolver campos petrolíferos não convencionais na bacia de Vaca Muerta, que acelerarão a produção de petróleo no país. A empresa anunciou planos para desenvolver três blocos adjacentes – Coiron Amargo Sur Oeste (CASO), Cruz de Lorena e Sierras Blancas – em um programa de seis anos a partir de 2019. A Shell acredita que esses blocos têm potencial para produzir até 70.000 b / d de óleo equivalente em 2025, acima da capacidade atual de 4.500 boe / d em 2018. A empresa planeja perfurar mais de 300 poços em 38 locais diferentes dentro dos blocos, abrangendo 400 quilômetros quadrados de áreas. A Shell vendeu sua empresa de downstream brasileira, a Raizen, por um considerável valor de US$ 916 milhões em outubro, em uma tentativa de levantar capital.

Fontes usadas:

Shell Argentina invests to increase shale output after selling downstream assets

Dec. 27 (UPI) — Shell Argentina, which two months ago sold a refinery and fuel stations, said Thursday it will move to develop unconventional oil fields in the Vaca Muerta basin, aiming at 70,000 barrels of oil equivalent per day by 2025.

The decision includes developing the Sierras Blancas, Cruz de Lorena and Coiron Amargo southwest blocks, the company told UPI in a statement sent by email on Thursday.

“Vaca Muerta makes up an important part of our global shale portfolio and we see substantial long-term growth potential there,” said Andy Brown, Shell Global Upstream Director.

“The first phase of development will consist of drilling and infrastructure expansion to increase production and processing capacity” from the current 12,000 barrels of oil equivalent per day to over 40,000 barrels of oil equivalent per day in 2021, the statement said.

RELATED G20 host Argentina battling worst economic crisis in a decade

“Full development of more than 70,000 barrels per day of oil capacity will follow by the mid 2020’s,” the statement said.

“The preliminary results from our early production (pilot wells) in Vaca Muerta have been positive and compare favorably with our shale benchmarks,” said Shell Argentina’s President, Sean Rooney.

Partners in these blocks are Gas y Petroleo de Neuquen (GyP) with a 10 percent interest in Sierras Blancas, Cruz de Lorena and Coiron Amargo Sur Oeste, and Vista Oil and Gas, with a 10 percent interest in Coiron Amargo Sur Oeste.

RELATED Argentina cracks down on anarchists after bombings ahead of G20 summit

Shell Argentina holds a 90 percent interest in Sierras Blancas and Cruz de Lorena and 80 percent in Coiron Amargo Sur Oeste.

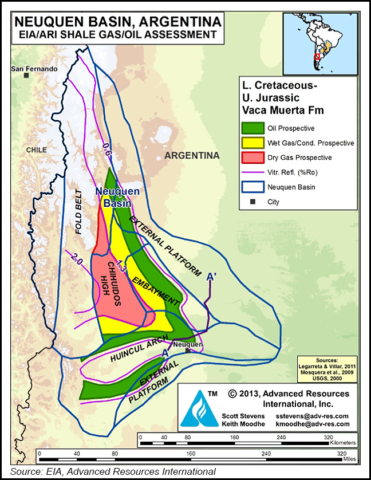

Shell Argentina in 2012 launched exploration and subsequent exploitation of unconventional oil and gas deposits in the Neuquen basin. Vaca Muerta plays an important role in the portfolio of future opportunities, Shell said.

According to private reports from earlier this year by Kallanish Energy, Argentina holds the second largest shale gas reserves and fourth largest shale oil reserves in the world.

RELATED Argentina considering probe into Saudi crown prince

“The South American nation is estimated to hold 27 billion barrels of technically recoverable shale oil reserves, and 802 trillion cubic feet of shale gas reserves,” the report said.

In addition, the government-owned oil company is also investing to increase overall production, including conventional.

“Argentina’s state-run YPF, the country’s largest oil and gas producer, will invest over $30 billion between 2018 and 2022, the report said. “It plans to increase hydrocarbons production by 5 percent per year, reaching 700,000 barrels of oil-equivalent per day in 2022.”

The decision by Shell to increase its upstream investment follows an announcement two months ago to sell downstream assets in the country.

Royal Dutch Shell completed in October the sale of its downstream business in Argentina to Brazil-based Raizen for $916 million in cash, subject to final price adjustments.

The sale included a Buenos Aires refinery, around 665 retail stations, liquefied petroleum gas, marine fuels, aviation fuels, bitumen, chemicals and lubricants businesses, as well as supply and distribution activities in the country.

Raizen is Brazil’s third biggest energy company.

Shell to launch major oil project in Argentina’s Vaca Muerta shale play next year

Buenos Aires — Shell plans to start a full-scale development project in Vaca Muerta next year, betting on the shale play to ramp up oil and natural gas production in Argentina, the government of Neuquen announced Thursday.

Not registered?

Receive daily email alerts, subscriber notes & personalize your experience.

Register Now Shell Argentina CEO Sean Rooney made a presentation Thursday of the company’s 2019-25 development plan for three adjacent blocks — Coiron Amargo Sur Oeste (CASO), Cruz de Lorena and Sierras Blancas — in the play to Neuquen’s governor Omar Gutierrez.

Shell will target shale oil in the six-year program in the province, the government said.

Gutierrez said the three blocks have potential to reach production of more than 70,000 b/d of oil equivalent in 2025, up from output of 4,500 boe/d this year.

The more immediate target is to reach 40,000 boe/d in 2021, he added.

RELATED VIDEO

5 commodity themes to watch in 2019

As the curtain closes on 2018, what will be the 5 themes to watch in energy and commodity markets during 2019? Martin Fraenkel, President of S&P Global Platts, delivers his verdict.

WATCH THE VIDEO

Shell’s program includes drilling more than 300 wells in 38 locations on the blocks, which cover a total of 400 sq km (98,800 acres). A new crude processing plant will be built as well, along with 100 km of roads, 75 km of oil and gas pipelines, power lines, and three water storage facilities and a new aqueduct for supplying the frac sites.

The project is “a new milestone in the development of Vaca Muerta, a strengthening in the structural and strategic development,” the governor said.

Shell, he added, is moving into mass development 18 months earlier than it could have, given that the field license allows it to run a pilot until 2020 before making a decision on what to do.

POSITIVE RESULTS

Rooney said “the preliminary results of the early production of our pilot projects in Vaca Muerta were positive,” adding that they are comparable to other shale plays in the world.

Shell has said that it plans to develop its oil assets in Vaca Muerta first, generating cash flow to then expand into the gas windows.

Shell has a 90% stake in Cruz de Lorena and Sierras Blancas, while the province’s state oil company, Gas y Petroleo del Neuquen (GyP) holds the remaining 10%. In CASO, GyP holds 10% and Mexico’s Vista Oil and Gas has 10%, while Shell owns 80%.

The project takes to seven the number of blocks in mass development in Vaca Muerta, out of a total of 34 licenses awarded so far.

Vaca Muerta, one of the world’s biggest shale plays, is leading a recovery in the country’s oil and gas production, with expectations that total output could double to 1 million b/d of crude and 260 million cu m/d of gas in 2023, allowing exports to reach 500,000 b/d and 80 million cu m/d by that time, according to an estimate by the Argentinian Energy Secretariat.

CHEVRON AND YPF

The announcement comes on the back of decisions by US-based Chevron and Argentina’s state-backed YPF to invest a total of $800 million in drilling 20 wells in 2019, targeting Vaca Muerta.

Chevron, one of the first big frackers in Vaca Muerta, will invest nearly $200 million in drilling eight wells in El Trapial, a conventional oil field it operates and which has shale potential.

YPF will invest $600 million in three blocks in the north of the province.

The companies will target shale oil, according to a December 21 statement by the provincial government.

-

Portos e Terminais

jun, 08, 2021

0

Santos Brasil bate recorde de movimentação em uma única embarcação

-

Portos e Terminais

jun, 06, 2024

0

Sindicatos marítimos da Argentina vão paralisar atividades portuárias por 48 horas

-

Economia

maio, 26, 2023

0

Exportações da Índia para América Latina aumentam 19% em 2022-23

-

Grãos

set, 27, 2022

0

Embarque de milho do Brasil supera 5 mi t no acumulado do mês até 4ª semana, diz Secex